Mar 31st Daily Analysis

Mar 31st Daily Analysis

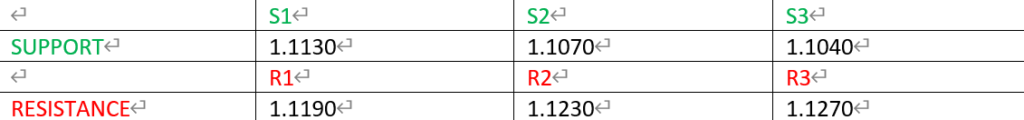

EURUSD

Due to its higher dependency on Moscow’s oil and energy, Russia’s invasion of Ukraine has spurred the oil and gasoline prices in Europe. ECB’s President Christine Lagarde spoke on the inflation outlook at an event hosted by the Bank of Cyprus on Wednesday, citing that no other catalyst is indicating inflation other than fuel and food.

From the overview of the price in EURUSD, the price seems to have changed its bias to the bullish trend. Based on the current movement of price, there could be a retest of the support level of 1.1130 which is in confluence with the retest of the 50 EMA before the price continues in the bullish direction.

PIVOT POINT: 1.1130

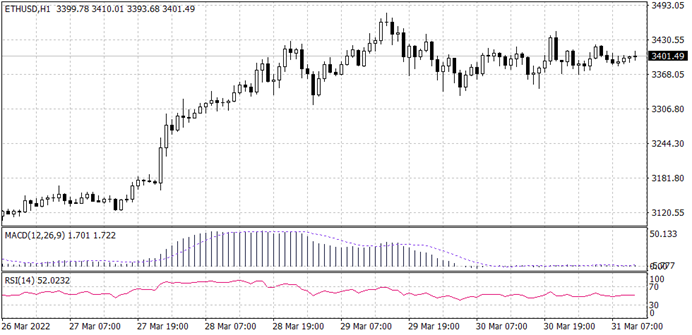

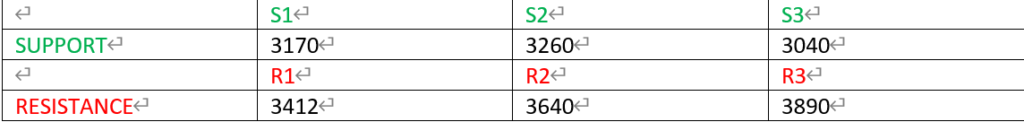

ETHUSD

The war between Ukraine and Spain has caused inflation in Germany and Spain to highs not seen in both countries since the 1980s. Since February, Spain’s consumer price index rose to nearly 10%, jumping by more than two percentage points. Germany took an initial step toward natural gas rationing, which about half the population uses for heating. Oanda Americas senior analyst Edward Moya said that after a week of gains “bitcoin’s rally” was “taking a breather and that should remain the case as war concerns completely dominate the short-term fate for most risky assets.”.

The overall trend for ETHUSD looks bullish. Price is currently at the resistance level of around 3,412. There could be a corrective move to the support level of 3,260.00 before the price continues in the bullish direction. The RSI and MACD are within the centre-line for a possible move in either direction.

PIVOT POINT: 3260

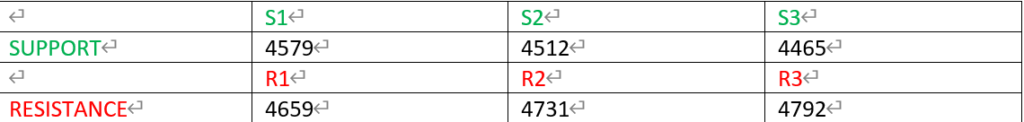

S&P 500 (SPX 500)

RH, the luxury home furnishings retailer formerly known as Restoration Hardware, is in a somewhat unusual position that gives Friedman a view into many parts of the economy. Like most retailers, RH was coming off a logistically difficult 2021, marked by the Omicron variant of Covid-19, which added an average of five weeks lead-time into the company’s supply chains.

From the overview of price in SPX 500, the overall trend looks bullish. Price is currently at the resistance level of 4,579 which may later lead to the continuation of price in the bullish direction. Alternatively, the price could retest deeply to the support level of 4513before pushing in the bullish direction

PIVOT POINT: 4512