March 30th Daily Analysis

March 30th Daily Analysis

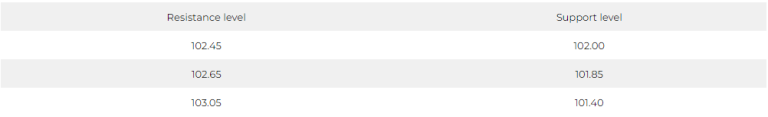

DOLLAR INDEX (USDX)

The dollar rose slightly against most of the major currencies on Wednesday to stabilize after falling over the past few sessions and rose sharply against the yen, which has been volatile as the Japanese fiscal year draws to a close.

The dollar index, which measures the performance of the greenback against six major currencies, rose 0.15% to 102.64.

It had fallen in the past two sessions and is expected to record a monthly loss of 2.1%, falling victim to market turmoil caused by problems in the banking sector.

Pivot Point: 102.25

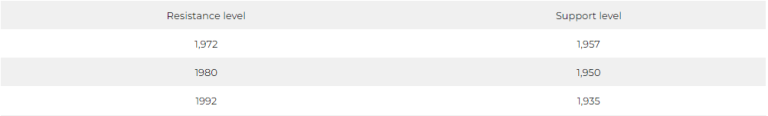

SPOT GOLD (XAUUSD)

Gold prices recorded losses in 4 sessions when settling the trading session of Wednesday, March 29, amid the dollar’s gains and the fading of investors’ appetite for safe havens.

Upon settlement, gold futures fell by 0.3%, or $5.9, to $1,984.5 an ounce.

Gold declined as the dollar rose, and concerns about the banking sector continued to recede.

Pivot Point: 1,965

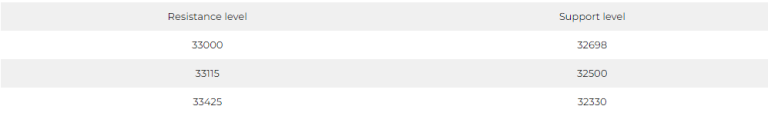

DOW JONES INDEX (DJ30FT – US30)

US indices closed with strong collective gains in yesterday’s session, Wednesday, supported by the optimistic expectations of Micron Technology Company, which dispelled some economic concerns on Wall Street, and some analysts consider that Micron Corporation is a microcosm of the global economy because its chips are involved in many different industries and sectors.

The Dow Jones index rose by 1%, or the equivalent of 323 points, surpassing 32,700 points, achieving its highest closing in 3 weeks.

The technology index rose by about 2%, topping the list of the sectors that gained the most.

Pivot Point: 32810

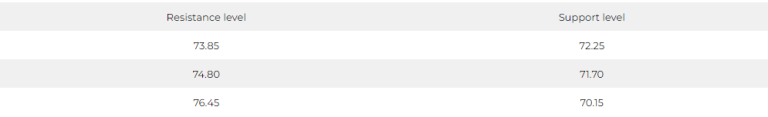

US Crude (USOUSD)

Oil prices fell at the settlement of yesterday’s trading session, Wednesday, March 29, despite the sharp drop in US inventories and amid investors’ aspiration to take profits by taking advantage of the price hike over two consecutive days.

Upon settlement, Brent crude futures fell by 0.5% to $78.28 a barrel, and US oil futures fell by 0.3%, recording $72.97 a barrel.

Pivot Point: 73.30