Mar 30th Daily Analysis

Mar 30th Daily Analysis

XAUUSD (GOLD SPOT)

Ukraine proposes to join the EU while adopting neutral status by not joining NATO. The Ukrainian presidential advisor Mykhailo Podolyak said they have prepared documents that allow the presidents to meet on a bilateral basis. Gold has witnessed a steep fall this week after failing to sustain above the grounds of $1,950.00. Still, a responsive buying slightly below $1,900 has pushed the gold prices near $1,920.00 an ounce.

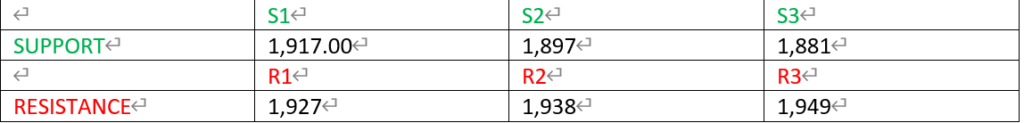

Gold seems to have changed the short-term trend to a bullish direction after a strong reduction around the $1,837 support level. Price is currently around the 1927 resistance level which may lead to a possible retest of the 1917 support level before pushing to the bullish direction. The RSI and MACD are above the centre-line for a bullish indication.

PIVOT POINT: 1,917

In addition to the current geopolitical situation in eastern Europe, the latest COVID update in China is weighing the currency market overall. As the Japanese Yen hold, the Sterling pound remains to fall. This trend is affecting the GBPJPY cross which is showing a high probability of a free fall. Also weighing the quote could be the pair traders’ caution ahead of the UK’s monthly data dump.

The overall trend for GBPUSD looks bearish. Price seems to have broken previous lows to the downside and there is a possible retest or corrective move to the support level of 1.13120. There seem to be possible confluences between the 50 EMA and the Fibonacci retracement level of 61.8 and 50.0 levels. The RSI and MACD are below the centre-line.

PIVOT LEVEL: 1.1320

USDJPY

The Bank of Japan (BoJ) kicked the rally off after the early intervention in the Japanese government bond (JGB) market across many segments of the curve. Governor Haruhiko Kurado of the Bank of Japan said that he had met with Prime Minister Fumio Kishida and claimed that the Yen had weakened on rising energy prices and expressed a desire for stable movement in currencies that reflects economic fundamentals.

From the overview of price in USDJPY, the price seems to have changed the overall trend to bearish. Price is currently retesting the resistance level of 121.30 which is a corrective move to the support level of 122.40 before continuing bearish. RSI and MACD are below the centre-line closing to the over-buying region.

PIVOT POINT: 122.40

BTCUSD

Russia has been hit with stringent financial and economic measures by the US and its allies over its invasion of Ukraine. But US lawmakers, among others, are concerned about the possibility those targeted might try to bypass the sanctions using digital assets.

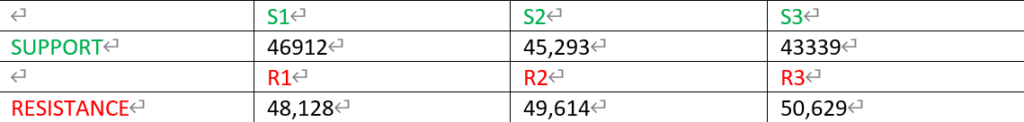

The price of BTCUSD is currently in consolidation after making an initial momentum to the bullish direction and resistance level of 48,128. Price has tested a minor support level of 46,912 which may lead to a continuous bullish trend. Alternatively, there is a possibility of the price making a major corrective move to the major support level of 45,293 before continuing in its bullish trend. The RSI and MACD are within the centre-line.

PIVOT POINT: 45,293