Mar 15th Daily Analysis

Mar 15th Daily Analysis

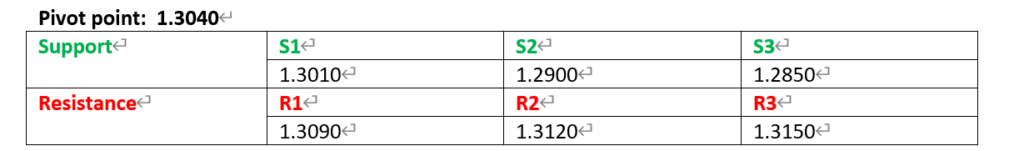

XAGUSD

The officials from both Russia and Ukraine have indeed progressed, suggesting there could be positive results within days. Moreover, the US Deputy Secretary of State Sherman confirmed that Russia showed signs of willingness to engage in substantive negotiations.

Silver (XAGUSD) dropped 3.17% during Monday’s US session, despite a risk-off market mood, which usually would boost appetite for precious metals and commodities amid uncertainty around the Russia-Ukraine conflict.

From the overview of XAGUSD price, the overall trend seems to be in the bearish direction after breaking the previous trend to the upside. Price is currently making a correction move to the support zone between 24.611 and 24.329 and is most likely to continue in its upward direction. The RSI and MACD are above the centre-line for added confirmation.

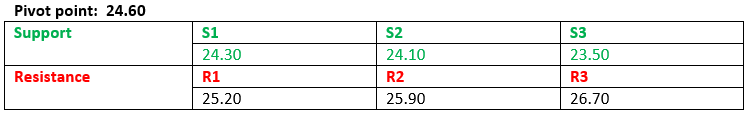

USOIL

Signs of a resolution to the military conflict between Russia and Ukraine have pushed down global crude oil prices, with US crude in Asian trade slipping 2.54% to $100.44 a barrel, in line with broader asset selling. Brent crude was down 2.27% to $104.42 per barrel.

From the overview of the price of WTI, the overall trend seems bearish as it is forming lower lows. Price is currently within the resistance level between $96.12 and $93.79. There could be a corrective move to the support zone around $100 before the price continues in its bearish direction. The RSI is already showing an overselling which signifies a possible reversal to the upside.

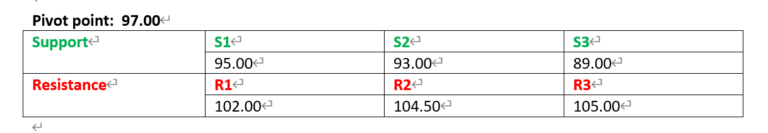

GBPJPY

The US T-bond yields portray the market’s firm belief that the Fed will rush for faster monetary policy tightening, stock futures in the US and Europe also printed mild gains amid expectations that Ukraine will have peace with Russia by May.

From the overview of price in GBPJPY, the price seems to have broken the previous low to the downside before making a corrective move to test the support zone between 154.603 and 154.142 which is in confluence with the retest of the 50ema. There could be a possible push to the downside after the retest. The MACD and RSI are below the canter-line for added confluence.