May 10th Daily Analysis

May 10th Daily Analysis3

DOLLAR INDEX (USDX)

According to a Gallup poll conducted on Tuesday, Americans’ confidence in Federal Reserve Chairman Jerome Powell’s economic management has fallen to the lowest level of any other central bank chief. The poll also indicated widespread skepticism about the country’s economic leadership in general.

The poll revealed that only 36% of respondents in the previous month had “a great deal” or “reasonable” confidence in Powell.

Investors are currently awaiting data on the consumer price index and inflation rates, which are crucial indicators that the Fed relies on in its decisions. The consumer price index is expected to rise on a monthly basis from 0.1% in the previous reading to 0.4%.

Pivot Point: 101.40

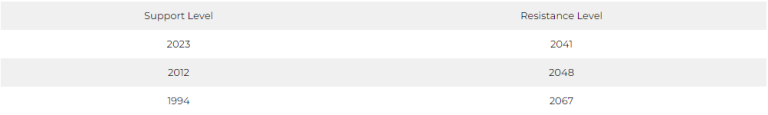

SPOT GOLD (XAUUSD)

On Wednesday, May 10, gold prices stabilized as traders awaited US inflation data scheduled for later in the day, which may influence monetary policy decisions issued by the US Federal Reserve.

In spot transactions, gold settled at $2032.86 an ounce, while US gold futures contracts dropped by 0.1% to $2041.50 an ounce.

The upcoming release of the Consumer Price Index (CPI) data in the US has garnered much attention from economists. According to a Reuters poll, they are anticipating a 5.5% year-on-year increase in core consumer prices for April.

Pivot Point: 2030

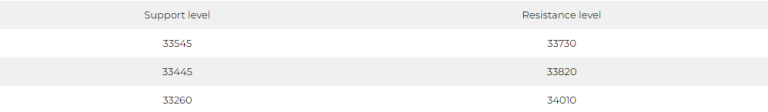

DOW JONES INDEX (DJ30FT – US30)

The main US indices closed with collective declines during Tuesday’s session as investors awaited inflation data and the results of the meeting of US leaders regarding raising the debt ceiling.

Investors are closely following the outcome of the meeting between US President Joe Biden and senior Republican lawmakers to discuss raising the US debt ceiling of $31.4 trillion. An unprecedented default is looming within three weeks if Congress does not take action.

The Dow Jones index declined by 0.17%, or 56 points, marking the second consecutive daily decline. Most sectors were in decline, and the index was under pressure from Apple’s shares, which fell by about 1%, dropping from near its highest level in about 9 months.

Pivot Point: 33635

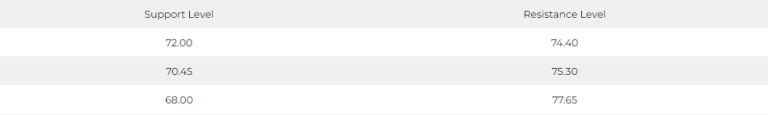

US CRUDE (USOUSD)

Oil prices rose on Tuesday after falling more than 2% earlier in the session. The rise was due to the US government’s announcement of plans to refill strategic reserves of crude, as well as expectations of higher seasonal demand.

Brent crude closed up 43 cents, or 0.6%, at $77.44 a barrel, while US West Texas Intermediate crude closed up 24 cents, or 0.3%, at $73.39.

US Energy Secretary Jennifer Granholm stated that the administration could start buying back crude oil for the Strategic Petroleum Reserve later this year. This comes after President Joe Biden issued the biggest sale yet of the stockpile last year.

Pivot Point: 72.85