April 03th Daily Analysis

April 03th Daily Analysis3

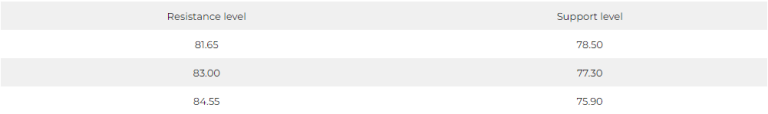

DOLLAR INDEX (USDX)

The dollar index futures rose to the level of 102.720 after shifts in interest rate expectations. The market now believes that the interest rate will rise by 25 basis points in the next meeting in May, between the level of 5.00%-5.25%, although the markets did expect before that the interest rate would rise at the next meeting.

Pivot Point: 102.08

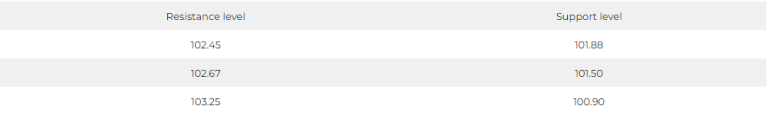

SPOT GOLD (XAUUSD)

Gold prices fell at the close of trading on Friday as the dollar gained more strength, but it achieved its second quarterly gain in a row in the first quarter of this year, as the growing bets that the Federal Reserve will slow the pace of raising interest rates as investors to turn to the precious metal.

Spot gold fell 0.6% to $1,968.25 an ounce after prices rose 0.4% following data showing US consumer spending rose modestly in February. US gold futures fell by 0.6% to $1986.2 an ounce.

The precious metal posted a monthly gain of 8.1% in March and a quarterly gain of 8.8% in the first quarter.

Pivot Point: 1,974

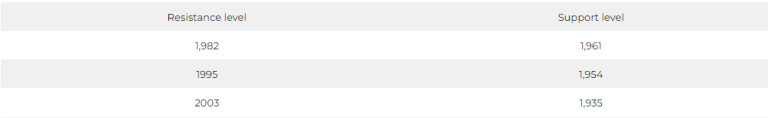

DOW JONES INDEX (DJ30FT – US30)

US stock indices rose at the close of trading on Friday, supported by the calm atmosphere over the banking crisis and the inflation data, which may discourage the Federal Reserve from raising interest rates further.

According to government data, the personal consumption expenditures index in the United States which is the preferred metric for the US Federal Reserve to measure inflation performance) slowed last month to 0.3% from 0.5% in the previous reading.

At the end of the Friday session, the Dow Jones rose by 1.3%, or 415 points, to 33,274 points, and the Nasdaq rose by 1.7%, or 208 points, to 12,222 points, while the Standard & Poor’s 500 rose by 1.4%, or 58 points, to 4,109 points.

The Standard & Poor’s and Nasdaq indices rose by 7.03% and 16.77%, respectively, in the first quarter. The quarter proved to be the best since 2020 for the Nasdaq Technology Index, while the Dow Jones ended the period with a gain of 0.4%.

Pivot Point: 33355

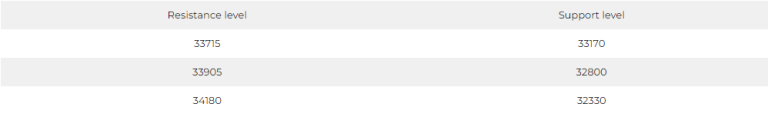

US Crude (USOUSD)

Oil prices jumped by more than 7% at the beginning of the week’s trading, supported by the sudden announcement of a voluntary cut in oil production by OPEC +.

Brent crude futures rose by 6.8% to $85.40 a barrel after hitting $86 a barrel in the first minutes of trading, compensating for the losses incurred due to the banking crisis, as crude fell below levels of $72, compared to $86 before its outbreak.

Nymex crude futures rose by 7%, recording $80.94 a barrel, after it exceeded $81 levels, and OPEC + unexpectedly revealed a production cut of about 1.15 million barrels per day.

Pivot Point: 80