April 25th Daily Analysis

April 25th Daily Analysis3

DOLLAR INDEX (USDX)

In early European trading on Monday, the US dollar saw a slight rise but remains on track for a second consecutive monthly loss. More economic data set to be released are expected to provide insight into the future direction of interest rates.

Currently, the dollar index is trading slightly lower at 101.345, with a monthly loss of approximately 1%, following a decline of over 2% in March.

The dollar’s recent decline can be attributed to concerns about a sharp slowdown in the US economy after it reached a 20-year high towards the end of last year.

Pivot Point: 101.24

SPOT GOLD (XAUUSD)

Gold futures rose at the settlement of Monday, April 24th, but closed below $2,000 levels.

Upon settlement, gold futures rose about 0.5%, or $9.30, to $1,999.8 an ounce.

Last week, gold prices fell below $2,000 an ounce due to the Fed’s statements in support of continuing to raise interest rates.

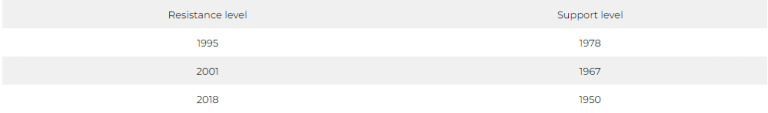

Pivot Point: 1985

DOW JONES INDEX (DJ30FT – US30)

US indices closed on divergence on Monday’s session amid anticipation of US GDP data and the results of several companies, including Microsoft.

Investors are eagerly anticipating the initial reading of the US economy’s performance in the first quarter of this year, with expectations that the country’s domestic product will grow by 3.7%.

The Dow Jones index rose 0.2%, equivalent to about 66 points, up for the second session in a row.

During Monday’s trading session, the energy index saw a gain of over 1%, making it the highest-performing sector in the Dow Jones. This increase was supported by a rise of approximately 1.4% in Chevron’s shares, which coincided with an improvement in oil prices. Additionally, the consumer sector index saw a rise, supported by Walmart’s shares increasing by 0.7%.

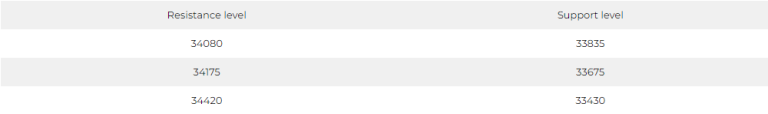

Pivot Point: 33930

US CRUDE (USOUSD)

Oil prices rose at the settlement of Monday, April 24th trading session, with expectations of an increase in fuel demand in China, after recording losses at the beginning of the session.

Upon settlement, Brent crude futures rose by 1.3% to $82.73 a barrel, and US oil futures rose by 1.1% to $78.76 a barrel.

Pivot Point: 78.15