March 13th Daily Analysis

March 13th Daily Analysis

DOLLAR INDEX (USDX)

The dollar fell on Monday, March 13th, as the US authorities intervened to curb the repercussions of the sudden collapse of the Silicon Valley Bank (SVB), as investors hoped that the US Fed would follow a less stringent monetary path.

Officials also said that depositors at Signature Bank, which was shut down by New York state financial regulators on Sunday, would be compensated and that taxpayers would not suffer any losses.

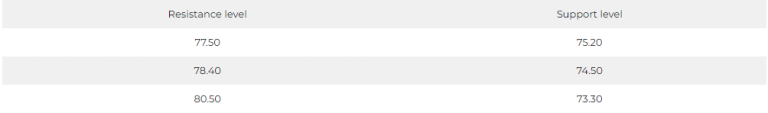

The dollar index, which measures the greenback against six currencies, fell 0.153% to 104.080. The Japanese yen rose 0.34% to 134.52 against the dollar, its highest level in a month, as investors moved towards safe-haven Asian currencies.

Pivot Point: 104.25

SPOT GOLD (XAUUSD)

Gold prices rose on Monday, March 13, to their highest levels in more than 5 weeks, with the decline of the dollar. Meanwhile, fears raised by the largest collapse of an American bank since the financial crisis in 2008 pushed investors towards the precious metal, which represents a safe haven.

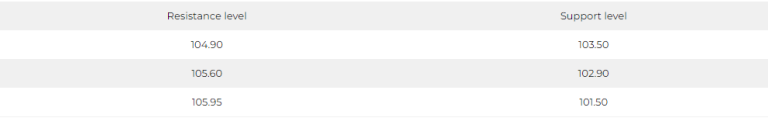

Gold rose in spot transactions by 0.5% to 1877.30 dollars an ounce after it recorded its highest level since February 3, earlier during the session, at 1893.96. Moreover, US gold futures increased 0.8% to 1882.10 dollars an ounce.

The US economy added 311,000 jobs in February, much more than expected, but the unemployment rate rose to 3.6%, and wage growth slowed, dampening expectations about the need to raise interest rates.

Pivot Point: 1,855

DOW JONES INDEX (DJ30FT – US30)

US stock indices fell at the close of trading on Friday, with the Dow Jones recording its largest weekly loss since last June due to the weak performance of the banking sector due to the Silicon Valley Bank crisis.

The losses in the banking sector came after the failure of the Silicon Valley Bank to raise financing targeting about two billion dollars on Wednesday, which caused the bank’s shares to lose 60% on Friday and more than 60% today before trading was suspended.

Today, US regulators announced the closure of SVB Bank, which marked the biggest failure of a Wall Street bank since the global financial crisis.

The SPDR S&P Regional Banking ETF exchange-traded funds for banks listed on Wall Street fell by about 4.4% and recorded weekly losses of about 16%, the largest since March 2020.

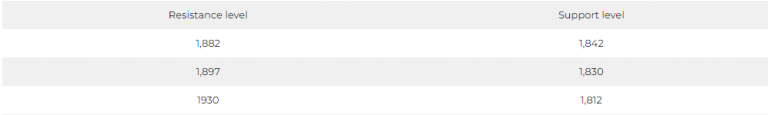

At the end of the Friday session, the Dow Jones index fell by 1.1%, or about 345 points, to 31,909 points, and its weekly losses amounted to 4.4%, the largest since June of 2022.

Soon, these losses were partially covered, so the Dow Jones is now trading above $32,200 after US officials intervened to stem the financial repercussions of the Silicon Valley bankruptcy, saying that all depositors would be able to dispose of their deposits as of Monday.

Pivot Point: 32070

US CRUDE OIL (USOUSD)

Oil prices rose more than 1% on Friday after US employment data, which came in better than expected, but crude suffered weekly losses due to concerns about interest policy on the part of the US Fed.

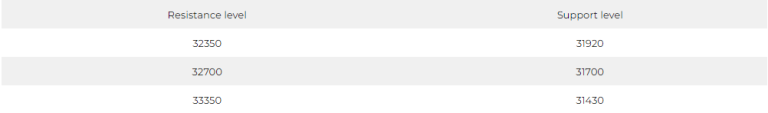

Brent crude rose $1.19, or 1.5%, to $82.78 a barrel, and its weekly loss was 3.5%. US West Texas Intermediate crude rose 96 cents, or 1.3%, to $76.68 a barrel and recorded a weekly loss of 3.7%.

Pivot Point: 76.15