October 07th Daily Analysis

October 07th Daily Analysis

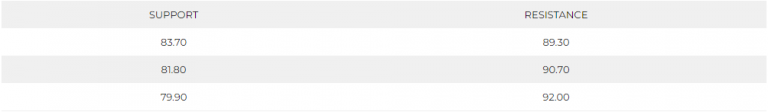

U.S. DOLLAR INDEX (USDX)

The dollar held onto strong overnight gains on Friday, buoyed by hawkish Federal Reserve speakers and as investors looked to a key jobs report later in the day for clues on how much further U.S. rates would need to rise.

The U.S. dollar index firmed to 112.22, after rising nearly 1% overnight, moving away from a low of 110.05 hits earlier in the week. All eyes now turn to the U.S. nonfarm payrolls report due later on Friday, with economists forecasting 248,000 jobs to have been added last month, compared with 315,000 in August.

Technically:

Technically, the index remains positive on both the daily and hourly charts after the correction. The hourly chart is bouncing after the correction hit 111.00. Meanwhile, the daily chart shows strong resistance below 112.30. On the other hand, technical indicators show a possible continuation of the uptrend on MACD figures and a horizontal trend signal on the RSI on the daily chart. The index remains positive as long as it is trading above 109.25.

Pivot Point: 112.05

EURO (EURUSD)

The European currency traded in negative territory below 0.9800 during the European session. The data from Germany showed that Retail Sales and Industrial Production contracted by 1.3% and 0.8%, respectively, in August. Meanwhile, investors await the U.S. September jobs report. While the Retail Sales data is contaminated with inflationary pressures, it has declined by 2%. However, market experts projected a decline of 1.7% following the prior release of 0.9%.

Technically:

EURUSD was down 0.45% at $0.9938 while it remains negative on the daily chart as long as it trades below the parity levels.

Pivot Point: 0.9800

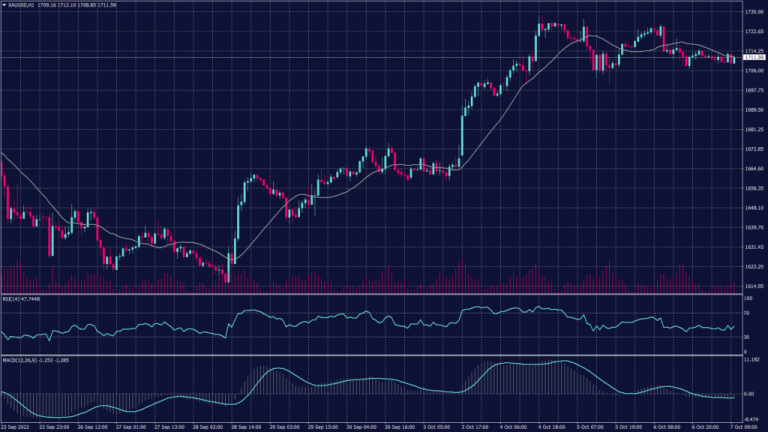

SPOT GOLD (XAUUSD)

Gold prices moved little on Friday as investors awaited key U.S. nonfarm payrolls data for more cues on the world’s largest economy but were headed for a second straight week of gains as pressure from the dollar eased. Focus is now squarely on U.S. nonfarm payrolls data, due later on Friday. While the reading is expected to have decreased from the prior month, any signs of strength are likely to give the Fed more space to keep hiking rates.

Bullion prices benefited as the dollar retreated further from a 20-year high this week, while U.S. Treasury yields also fell as markets bet that weakening economic growth will push the Fed into eventually softening its hawkish stance. Spot gold was largely unchanged at $1,712.03 an ounce, while gold futures were also steady at around $1,720.25 an ounce.

Technically:

The 14-day Relative Strength Index (RSI) is inching higher above the midline, supporting the renewed upside in the metal. A sustained break above the 50 DMA is needed to challenge the September highs at $1,735. Alternatively, sellers could test the previous critical resistance now support at $1,700 before approaching Tuesday’s low of $1,695.

Pivot Point: 1,710

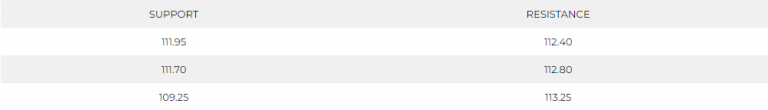

WEST TEXAS CRUDE (USOUSD)

Oil prices steadied on Friday ahead of key U.S. economic data after rising over 1% in the last session on cuts to OPEC+ production targets. Brent crude futures slipped 11 cents to $94.31 a barrel. WTI crude futures were down to $88.40 a barrel, after hitting $89.37 per barrel earlier. However, both benchmarks were headed for weekly gains, fuelled by a production cut announcement by OPEC+.

WTI spot contracts remain inside the declining daily channel despite reaching the highest level since mid-September. In order to break into the uptrend, WTI prices should close the day near $91.35 a barrel. However, the 14-day RSI shows a slowdown in the momentum and a possibility of a continuation to the downside. Meanwhile, the MACD readings show a horizontal trading pattern.

On the hourly chart, technical indicators are peaking and are signaling a possible turn to the downside. However, moving averages 20 and 50 are still supporting the uptrend.

Pivot Point: 88.00