August 31th Daily Analysis

August 31th Daily Analysis

U.S. DOLLAR INDEX (USDX)

The U.S. dollar edged lower in early European trade Tuesday, falling back from a 20-year peak, as attention turns towards Europe, with Wednesday’s Eurozone inflation data likely to point to an aggressive ECB interest rate hike next month.

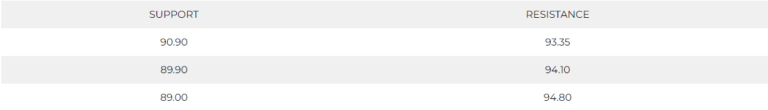

Meanwhile, Market participants will be watching the nonfarm payrolls report and employment data carefully to try to figure out whether the Fed can pull off an economic slowdown without triggering a recession. The Dollar Index traded 0.1% lower at 108.733, after dropping from its 20-year high at 109.48.

Technically, the index dropped this morning from 108.70 to 108.40 in one hourly candle to test the support at 108.40 for the third time since the last session. Furthermore, the daily chart remains positive targeting 109.80 and 110.20 if the resistance at 109.40 was penetrated. However, the hourly chart shows a slight slowdown and decline over the last few hours in the chart.

Pivot Point: 108.40

EURO (EURUSD)

Market participants wait for the European CPI figures on Wednesday, with annual inflation expected to accelerate to 9.0% from 8.9% in July, well above the ECB’s 2% target. The data will likely add to pressure on the ECB to hike rates aggressively at its upcoming September meeting even amid the mounting risk of a recession. The EURUSD pair edged above the parity levels, after rallying 0.3% on Monday, its biggest rise in almost three weeks.

The EURUSD pair bounced up towards the resistance 1.0033 to fluctuate between the Fibonacci levels of 23.6 and 0.0 (1.0005 and 1.0033) which shows a possible break out to 1.0055. Technical indicators show a possibility for the continuation of the downtrend regardless of the RSI neutral level at the daily chart and remain to pressure the current levels towards 0.9850.

Pivot Point: 1.0023

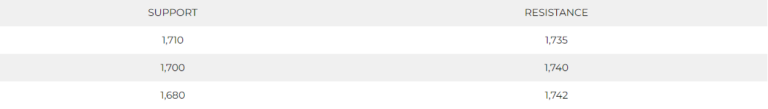

SPOT GOLD (XAUUSD)

Gold prices fell on Wednesday and were set for a fifth straight month of losses amid fears of aggressive policy tightening by the Federal Reserve. Spot gold fell 0.2% to $1,721.67 an ounce, while gold futures dropped 0.2% to $1,732.85 an ounce.

Spot gold remains negative on both the daily and hourly time frames, but it shows a horizontal trend on the hourly chart. Meanwhile, the daily chart shows a sharper and clearer downtrend targeting levels near $1,700 per ounce.

Pivot Point: 1,720

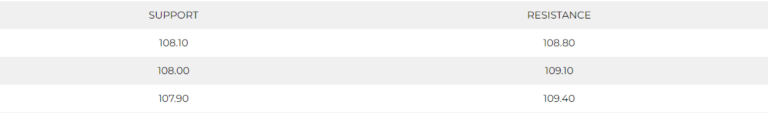

WEST TEXAS CRUDE (USOUSD)

Oil prices recovered slightly on Wednesday as data pointed to firm fuel demand in the United States, providing respite after a 5% drop a day earlier on fear of demand suffering from increased China COVID-19 curbs and central bank interest rate hikes. WTI crude jumped 0.9% to $92.49 a barrel while Brent climbed 0.7% to $100.01 a barrel.

WTI rebounded from the support at 93.20 reaching above $94.50 per barrel and rising. However, the overall trend remains negative on the daily time frame unless prices broke above $96.20 per barrel which is the neckline of the double bottom on the daily chart.

Pivot Point: 91.60