Mar 18th Daily Analysis

Mar 18th Daily Analysis

NATURAL GAS (Gas-C)

Gas prices are up as much as 77 cents from last month. Some US shoppers are signing up for Costco memberships in order to buy cheaper gas.

Over the past few days, dozens of consumers have touted the benefits of a Costco membership on Twitter, saying that it’s a more affordable place to buy gas as prices continue to soar in the US.

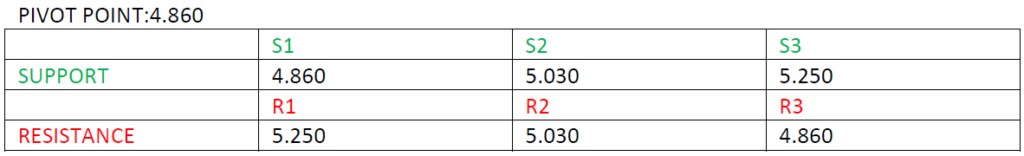

The trend for natural gas is bullish after breaking previous structures to the upside. Price is currently making a corrective move to the support area 4.860 which has confluences with the 50 EMA and the FIBONACCI retracement levels between 50.0 and 61.8. The RSI and MACD are above the center-line which signifies a possible continuation of a bullish run.

BTCUSD

Ukrainian President Volodymyr Zelenskyy signed on Wednesday a virtual assets law that was passed by parliamentary policymakers in September 2021. The cryptocurrency sector is now legal in Ukraine with the newly minted status arriving as the country has spent millions of dollars in cryptocurrency donations to buy supplies to defend itself during Russia’s invasion. The National Bank of Ukraine and the National Commission on Securities and Stock Market will oversee regulatory duties such as licensing digital asset providers.

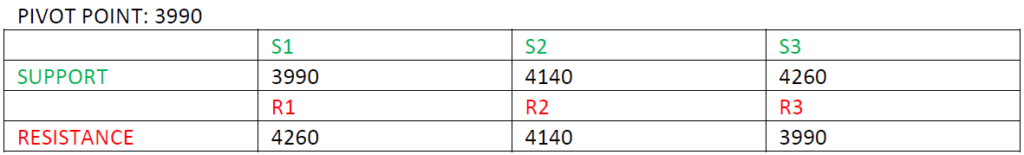

From the overview of price in BTCUSD, the overall trend seems bullish after breaking the previous high. Price is in a corrective move to the support area of 3,990 before a possible push to the upside. The RSI and MACD are below the centre-line and may hit the oversold level after the corrective move is complete before pushing to the upside.

EURUSD

Ukrainian and Russian diplomats haven’t yet finished the negotiations table, The Western warning over Moscow’s likely usage of chemical weapons and China’s likely readiness to support the Russian invasion of Ukraine weigh on the market’s fear.

In Europe, the inflation woes renew with the firmer prices of oil, as well as upbeat inflation data from the Eurozone. Multiple policymakers from the European Central Bank (ECB), including President Christine Lagarde, tried to tame the fears of faster monetary policy tightening.

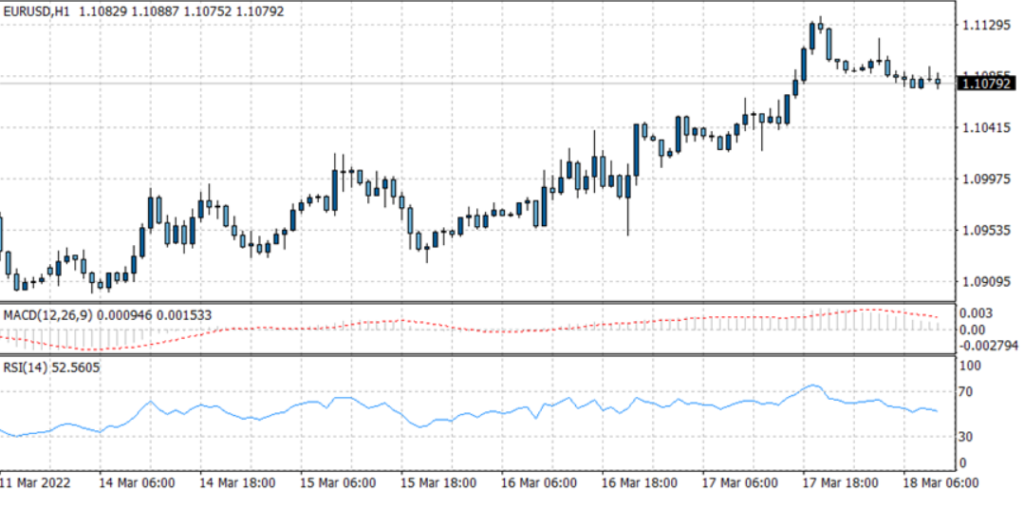

EURUSD remains pressured around 1.1085, printing the first negative daily performance in five during early Friday morning in Europe. 21-DMA contests EURUSD’s immediate upside around 1.1100 but major attention is given to the horizontal line comprising multiple levels marked since late January and a five-week-old descending resistance line, around 1.1120. Given the firmer MACD and ascending RSI line, the pair does not show to be overbought.