Manager Info

FCF

We are a leading AI investment consultancy fintech company with both production, learning and research. We committed to use technology to change prosperity, use finance to change life.

Team Size

Country

30

China(Shanghai,Beijing,Shandong)

Historic Return

Product Mainly Traded

Monthly: 7-15%

Annually: 20%-48%

Forex, Gold Index, US Stocks

Investment Strategy

EA Manual

Martingale and hedge

EA 80% Manual 20%

The Age of Artificial Intelligence & Robo-Advisors

Financial investment service market in the future will be a customized investment strategy based on the execution of AI and big data. All the trades on financial products will be based on qualitative trading system built by variety of mathematic mode. Financial market in the future will be a mixed competition of “talent+ tech.”

Intelligent Trade is the future basic tool of the Pan-Financial Era

Intelligent qualitative is the innovative movement of new investment industry. It is the combination of artificial intelligence and qualitative investment. It stimulates traders’ orders by advanced numbers model, stats model and computer process via computer and cloud server, and combining human thinking, investment strategy, successful trading method, via huge amount of data stats in the market, market trend.

Intelligent Qualitative Features

-

Intelligent

It has the human intelligent behavior. Complete tasks automatically.

-

Automation

A good intelligent qualitative system is a money printing machine

-

discipline

All the strategies are based on the calculation model

-

System

There is a limitation on human brain data processing. Intelligent qualitative can combine different strategies, forming a system of safety, profit and risk diversification.

Variety of Investment Products

Through portfolio with variety of strategies and types including commodity, forex, stocks, precious metal, crude oil, index), at the same time, earn the average profit under the market volatility with risk controlled, to achieve the target of long term steady expected profit.

Different Types Of Portfolio Products

Type: Stable

Investment Amount: USD 100K

Protection Mechanism: 100% Protected

Expected Annualized Return: 20-36%

Investment Period: 1 year

Type: Aggressive

Investment Amount: USD 10K

Protection Mechanism: Protected at 30% drawback

Expected Monthly Return: 7-15%

Investment Period: 3 Month min

Type: Standard

Investment Amount: USD 20K

Protection Mechanism: Protected at 20% drawback

Expected Monthly Return: 5-8%

Investment Period: 6 Months Min

Service Charge: 30% from the profit

Type: Easy Wealth

Investment Amount: USD 30K

Protection Mechanism: Protected at 50% drawback

Expected Monthly Return: 24-48%

Investment Period: 6 Month min

Service Charge: 60% from the profit

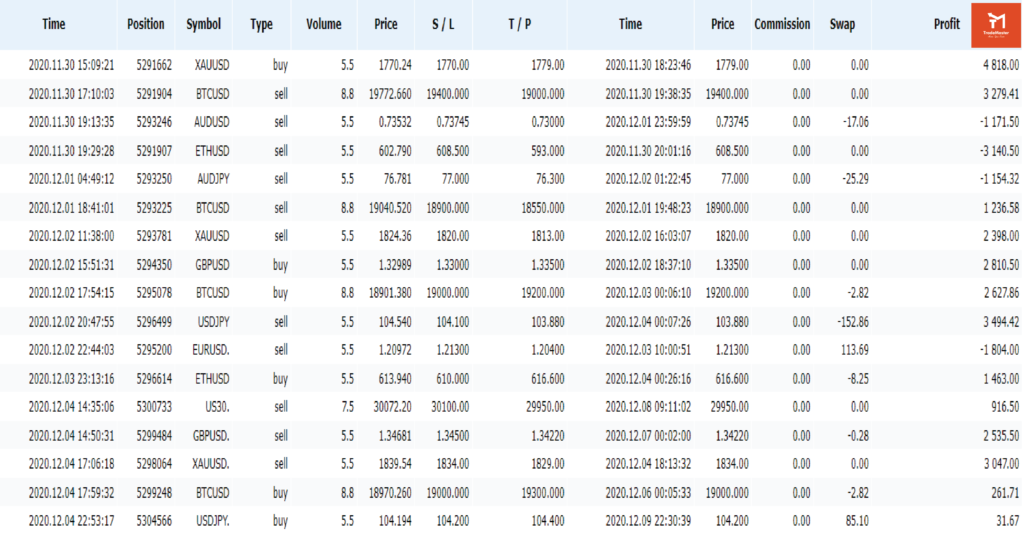

Demonstration of different traders

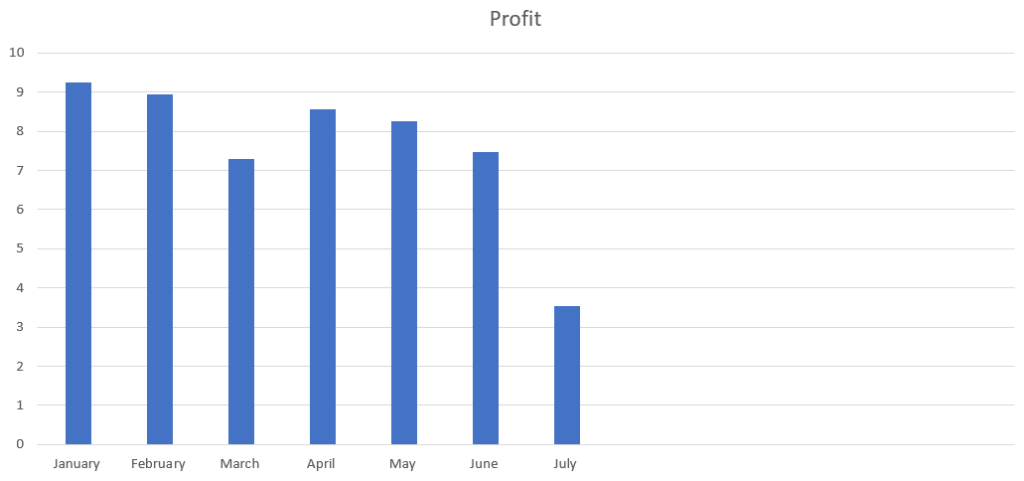

Alpha Trader

Trading record chart starting from Jan 2018.

Monthly return 89.5%. Biggest monthly drawback 8.54%

Accumulated result: 169.29%

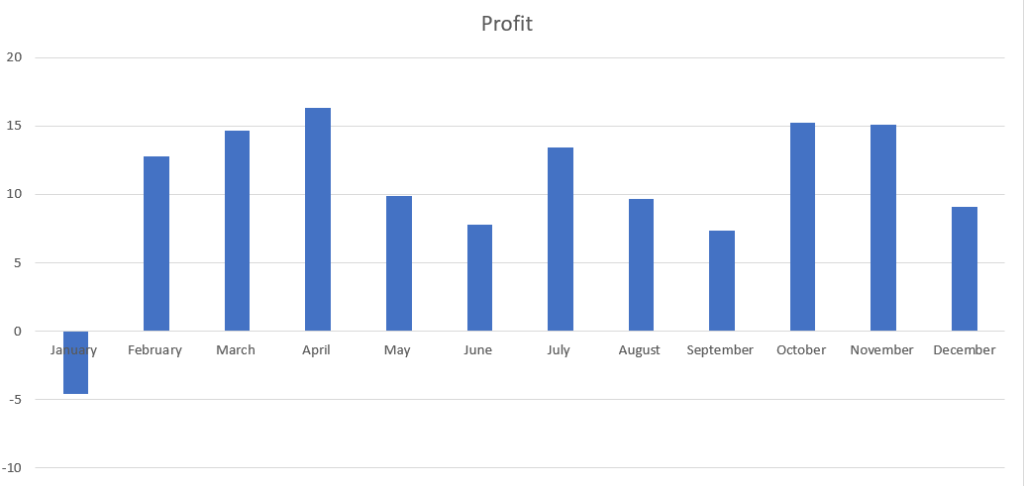

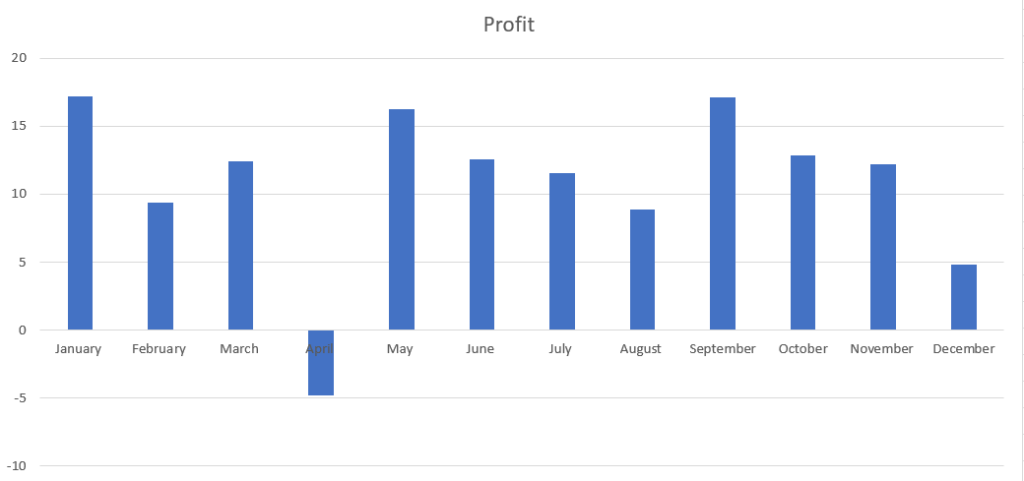

Beta Trader

Trading record chart starting from Jan 2018.

Monthly earning ratio 100%.

No drawback in months

Accumulated result: 169.94%

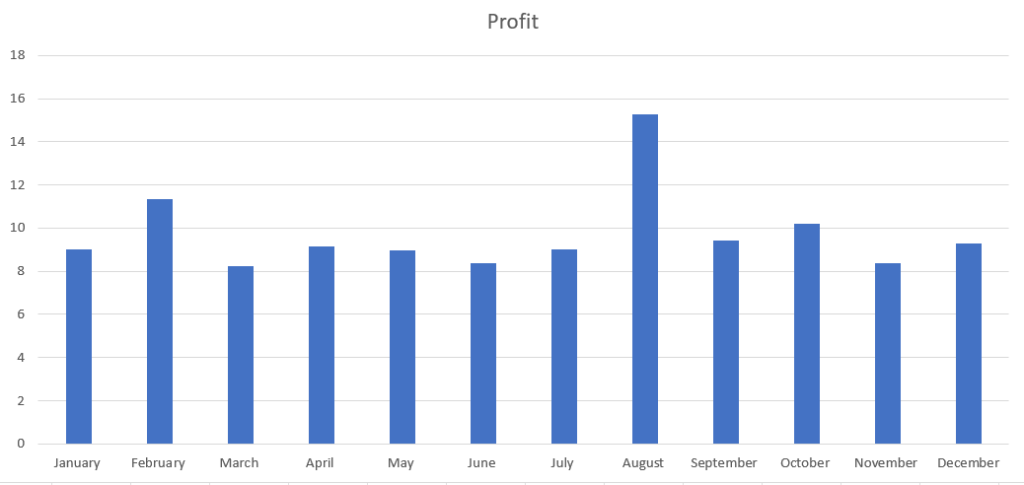

Gamma Trader

Trading record chart starting from Jan 2018.

Monthly earning ratio 100%.

Biggest monthly drawback: 4.84%

Accumulated result: 177.06%

FCF

We are a leading AI investment consultancy fintech company with both production, learning and research. We committed to use technology to change prosperity, use finance to change life.

Team Size

30

Country

China(Shanghai,Beijing,Shandong)

Historical Return

Monthly return 7-15% Annual return 20%-48%

Product Mainly Traded

Forex Gold Index US Stocks

Investment Strategy

Martingale and hedge

EA Manual

EA 80% Manual 20%