September 26th Daily Analysis

September 26th Daily Analysis

U.S. DOLLAR INDEX (USDX)

The dollar index reached 114.58 for the first time since May 2002 before easing to 113.73, 0.52% higher than the end of last week. Weakness in major currencies pushed the dollar index to touch a new 20-year high on Monday, as the greenback continued to benefit from safe-haven buying.

Rising U.S. interest rates have boosted the reserve currency this year and are likely to keep it elevated in the near term. The Fed signaled last week that U.S. interest rates are set to rise even further this year, likely ending 2022 at a 16-year high of 4.4%.

Technically, the index remains positive on both the daily and hourly charts after exceeding the 114 level. However, despite the slowdown on the hourly chart towards 113, the technical indicators remain positive and signal a bullish trend after the correction to 112.90.

Pivot Point: 113.00

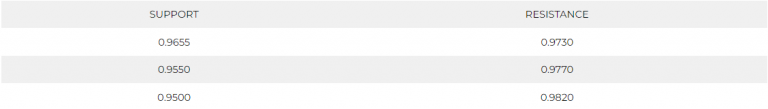

EURO (EURUSD)

The euro slumped 0.5% to a new 22-year low of $.09540. A batch of weak Eurozone economic readings last week saw investors pricing in a likely recession in the eurozone. Fears of a brewing energy crisis and a potential escalation in the Russia-Ukraine war also dented sentiment towards the currency. A weekend election in Italy was also set to propel a right-wing alliance to a clear majority in parliament.

The daily chart is showing heavy pressure below the parity levels and confirms the downtrend towards 0.9500. The hourly chart signals further decline with no strong support.

Pivot Point: 0.9685

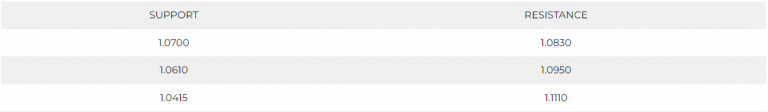

STERLING POUND (GBPUSD)

Sterling tumbled to a record low as traders speculate the new government’s economic plan will stretch Britain’s finances to the limit. Sterling slumped as much as 4.9% to an all-time bottom of $1.0327, before stabilising above $1.05405, 2.9% below the previous session’s close.

British government bond yields surged by the most in a day in more than three decades on Friday, with yields on the five-year gilt – one of the most sensitive to any near-term shift in the interest rate or borrowing expectations – up by half a percentage point.

The intervention followed the decision of the Bank of Japan to maintain its ultra-easy monetary policy. This provided a direct contrast to the stance taken by the Federal Reserve on Wednesday when the U.S. central bank lifted rates by 75 basis points and signalled that its interest rates will climb higher and stay elevated for longer than the markets had previously priced in.

Technically, the cable remains negative below the level of 1.0830 despite the correction from 1.0290 and signals a possible decline from 1.0830. The technical indicators show a slow down in the downtrend while remains far from changing the direction. Meanwhile, the daily chart is also negative and MACD is showing a possibility of further decline towards the parity levels.

Pivot Point: 1.0775

SPOT GOLD (XAUUSD)

Gold prices retreated further as the dollar notched a new 20-year high amid growing fears of rising interest rates and a potential economic recession. Markets plummeted last week after the U.S. Federal Reserve hiked interest rates and warned of potential economic pain as it looks to combat runaway inflation. Spot gold was unchanged at around $1,643.82 an ounce, while gold futures fell 0.3% to $1,651.30 an ounce. Both instruments are trading at their lowest level since early 2020, after logging sharp losses last week.

Technically, the precious metal remains under selling pressure below $1,650 per ounce on the hourly chart. However, technical indicators show a possibility of fluctuation and a slight rebound to 1,650 during the European session.

Pivot Point: 1,646

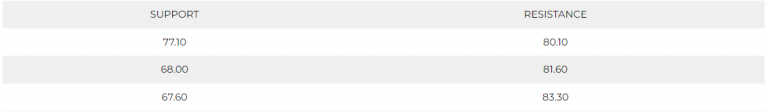

WEST TEXAS CRUDE (USOUSD)

Oil prices fell for a second day on fears of lower fuel demand from an expected global recession sparked by rising worldwide interest rates and as a surging U.S. dollar limits the ability of non-dollar consumers to purchase crude. Both contracts slumped around 5% on Friday. Today, Brent crude futures slipped 1.57% to $84.80 a barrel, while WTI crude futures delivery dropped 1.46% to $77.59 a barrel.

WTI is moving in a slow fashion that might lead to a horizontal trend below $80 per barrel. However, technical indicators show neutral signals, but price action shows a tendency for negative movement.

Pivot Point: 78.00