January 19th Daily Analysis

January 19th Daily Analysis

U.S. DOLLAR INDEX (USDX)

The dollar rose broadly on Thursday as growing concerns about the U.S. economy drove demand for the safe-haven greenback.

Weak U.S. data released showed that U.S. retail sales fell by the most in a year in December and manufacturing output recorded its biggest drop in nearly two years, stoking fears that the world’s largest economy is headed for a recession.

The dollar index trades under heavy selling pressure and remains committed to the downtrend that started in early November. Meanwhile, the hourly chart shows robust selling pressure despite the overselling readings from RSI and MACD.

Pivot Point: 102.10

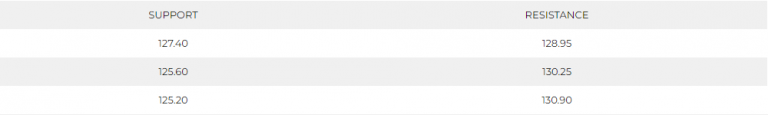

JAPANESE YEN (USDJPY)

The yen was the best-performing Asian currency this morning as it gained 0.5% to 128.29 against the greenback. The currency had plummeted as much as 2.5% on Wednesday after the BOJ unexpectedly maintained its current course of yield curve control.

But speculation that rising inflation will push the bank into eventually altering its ultra-loose policy saw the yen recover sharply from intraday lows. Japanese consumer inflation data is due this Friday and is expected to read at 4%, twice the BOJ’s annual target.

Data showing a massive current account surplus in November also indicated that some facets of the Japanese economy remained strong despite broader headwinds.

Pivot Point: 128.00

SPOT GOLD (XAUUSD)

Gold prices recovered slightly from a two-day losing streak on Thursday amid growing uncertainty over a potential recession and the path of U.S. monetary policy.

U.S. retail sales and industrial production data for December read weaker than expected, ramping up concerns over a broader economic slowdown in the country as it struggles with tight monetary policy and relatively high inflation. A report from the Federal Reserve also forecasts little economic growth in the coming months, even as price pressures ease. Spot gold rose 0.2% to $1,907.60 an ounce, while gold futures rose 0.1% to $1,909.15 an ounce.

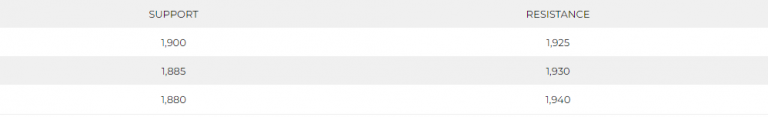

Spot gold remains solid and hits the strong resistance at 1,930 while keeping the buying pressure at the highest levels in a few months. Gold remains supported above the range between 1,910 and 1,920 despite the correction from 1,930 to 1,905.

Pivot Point: 1,910

WTI FUTURES (CL-OIL)

Oil prices fell further on Thursday as industry data signalled another big weekly build in U.S. crude inventories, while weak economic data and a potential rise in interest rates fanned growing fears over a looming recession.

Data from the American Petroleum Institute showed that U.S. oil inventories grew 7.6 million barrels last week, bucking expectations for a drop for a second consecutive week. Brent oil futures fell 1.3% to $83.86 a barrel, while WTI futures fell 1.6% to $78.56 a barrel. Both contracts slipped more than 1% on Wednesday following the weak U.S. economic readings.

Oil prices have been buoyed by a slide in the dollar to a nearly nine-month low, reinforcing expectations the Federal Reserve would slow the pace of rate hikes. A weaker greenback tends to boost demand for oil as it makes the commodity cheaper for buyers holding other currencies.

Pivot Point: 79.10