May 01st Daily Analysis

May 01st Daily Analysis3

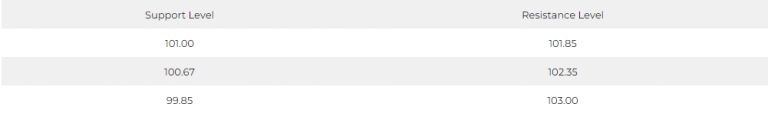

DOLLAR INDEX (USDX)

The dollar index rebounded 0.45% to 101.710, recovering from its lowest level in almost two weeks. However, the greenback remained on track for a monthly loss of just under 1% after a 2.3% drop in March. Traders had concerns about the soundness of the US banking system and the prospects for the Fed to end its monetary tightening policy, as the country’s economic growth faltered.

Pivot Point: 101.50

SPOT GOLD (XAUUSD)

Gold prices increased during Friday’s trading session due to a drop in returns and renewed concerns about banking instability in the US.

Gold prices increased during Friday’s trading session due to a drop in returns and renewed concerns about banking instability in the US. Upon settlement, US gold contracts rose by about ten cents to close at $1999.1 per ounce, recording a weekly gain of 0.43%. In April, gold prices saw a monthly gain of 0.65%, marking the fifth monthly gain in the past six months.

Pivot Point: 1986

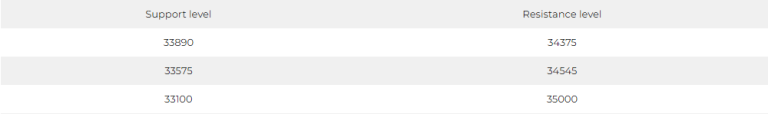

DOW JONES INDEX (DJ30FT – US30)

Strong corporate earnings outweighed recession fears, leading to a collective rise in US indices during Friday’s trading session.

In March, US consumer spending remained unchanged, while underlying inflation pressures remained strong according to data, which reinforced expectations that the Federal Reserve would raise interest rates by 25 basis points the following week.

The Dow Jones index climbed 0.8%, or approximately 272 points, reaching its highest closing level in two and a half months. The index also recorded a monthly increase of about 2.5% in April, marking gains for the second consecutive month.

Pivot Point: 34060

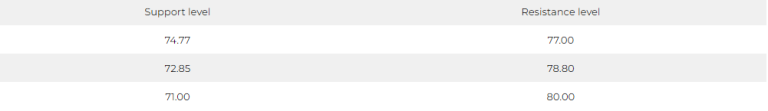

US CRUDE (USOUSD)

As of May 1, many countries participating in the “OPEC+” agreement have initiated a voluntary reduction in oil production. This production cut will continue until the end of 2023, resulting in a total decrease of 1.66 million barrels per day.

West Texas Intermediate crude futures saw a slight decline of 0.07%, dropping to $76.58 per barrel, while Brent crude also experienced a decrease.

The decline can be attributed to disappointing Chinese data, as the Chinese Industrial Purchasing Managers’ Index revealed a contraction in the economy with a reading of 49.2, while the services index fell to 56.4, down from the previous reading of 58.2. The composite index also fell to 54.4, compared to the previous reading of 57.0.

Pivot Point: 75.80