February 28th Daily Analysis

February 28th Daily Analysis

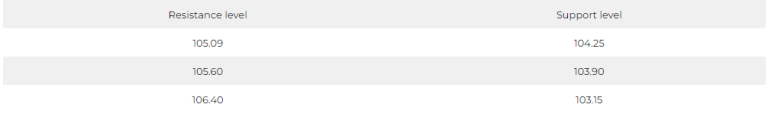

DOLLAR INDEX (USDX)

The dollar index declined by 0.4% after reaching a seven-week peak after Durable Goods Orders (M/M) came out less than expected at (-4.5%).

Technically, the US dollar index is trying to test the resistance levels at 104.78, supported by momentum indicators.

Pivot Point: 104.78

BRITISH POUND (GBPUSD)

On Monday, Prime Minister Rishi Sunak signed a new trade agreement with the European Union to address issues relating to Northern Ireland. As a result, the British pound rose 0.9% against the US dollar, hitting a session high of $1.2051.

Pivot Point: 1.2010

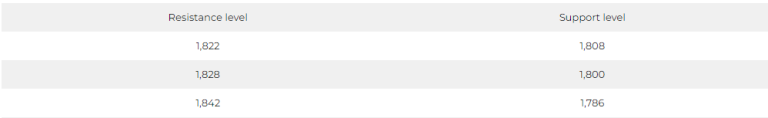

SPOT GOLD (XAUUSD)

On Monday, Gold prices rose with the decline in the dollar’s gains. However, the precious metal remained near its lowest level in two months amid continuing fears of further rate hikes by the US Federal Council.

And gold prices increased in spot transactions, by 0.4%, to $ 1817.69 an ounce. Moreover, US gold futures rose by 0.4% to reach $1824.90 at the settlement.

Pivot Point: 1,814

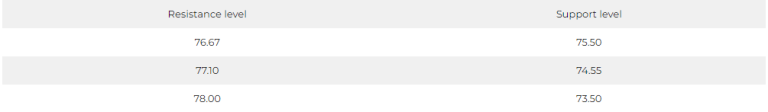

US CRUDE OIL (USOUSD)

Analysts at Goldman Sachs said that the strong recovery of fuel demand in China and the stability of the volume of supplies from producers who are not members of the Organization of the Petroleum Exporting Countries (OPEC) would push the oil market into deficit in the second half of this year, prompting OPEC to retreat from Cut production at the meeting of June.

OPEC +, which includes OPEC and allies including Russia, agreed in October to cut oil production targets by 2 million barrels per day until the end of 2023.

On Sunday, the bank said in a note that it expects oil prices to rise gradually to $100 a barrel by December, assuming an increase in OPEC production by one million barrels per day in the second half.

The bank added that if OPEC maintains its current production, the Brent price is likely to reach $ 107 a barrel in December and continue to rise thereafter.

Pivot Point: 75.80