Mar 23rd Daily Analysis

Mar 23rd Daily Analysis

Sterling pound (GBPUSD)

Ahead of the disclosure of Consumer Price Index (CPI) numbers on Wednesday, GBPUSD has been performing stronger. A preliminary estimate for the yearly UK’s CPI is 5.9%, much higher than the previous print of 5.5%. GBPUSD has witnessed a strong upside move on Tuesday amid the improvement in demand for risk-sensitive assets after the DXY weakens as investors digested the announcement of seven interest rate hikes in 2022.

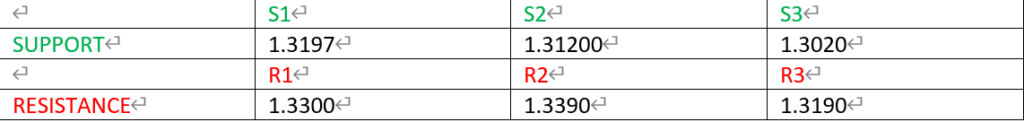

From the daily time frame, the trend seems to have changed the bullish direction after breaking previous highs. Price is currently reacting to the resistance level of 1.3300 which is also in divergence with the RSI indicator on the 1-hour chart. There could be a possible reversal to the bearish direction if the price bounced from the resistance level.

PIVOT POINT: 1.3190

Chinese Yuan (USDCNH)

The yen fell about 0.4% to briefly hit 120.08 per dollar in early Asia trade. It is down about 4% this month as leaping U.S. yields have lured flows from Japan. The yen fell through the psychological 120 level for the first time since 2016 on Tuesday, after a hawkish speech from Federal Reserve Chair Jerome Powell raised bets on higher U.S. interest rates and widened the policy gap on a dovish Bank of Japan.

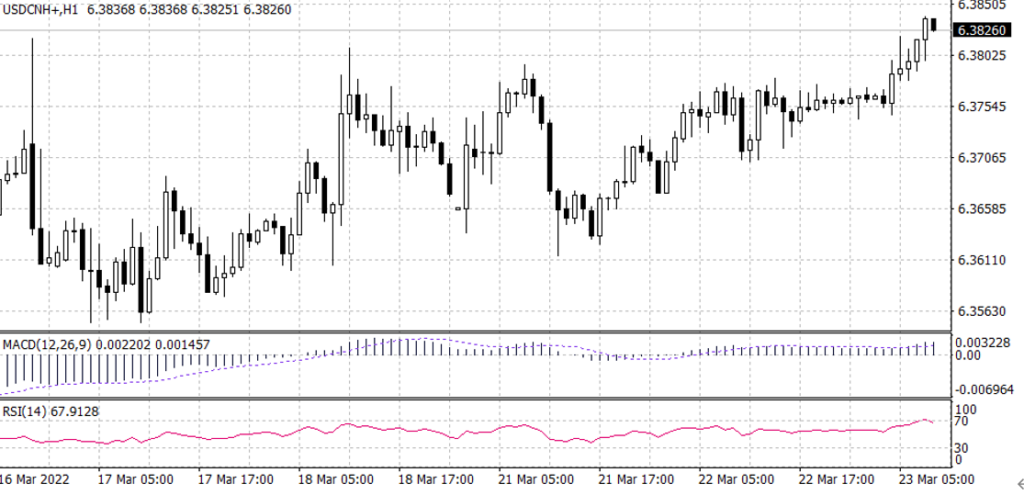

The overall trend for USDCNH from the daily time frame is bullish. Price has currently broken off of a resistance level of 6.3770 and approaching the next minor resistance level of 6.3890 then a possible retest to the support level of 6.3770 before continuing in its bullish trend. The RSI and MACD are above the centre-line for added confirmation in its overall trend direction.

PIVOT POINT: 6.3530