April 1st Daily Analysis

April 1st Daily Analysis

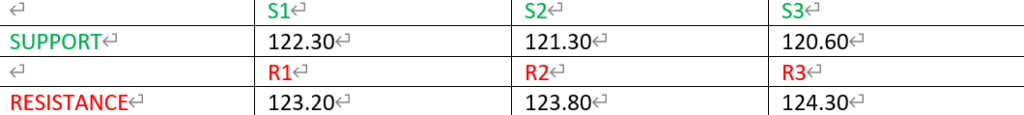

USDJPY

Ahead of a key U.S. jobs report that could cement the potential for a 50 basis-point Federal Reserve interest rate hike, the dollar extended a rebound versus major peers on Friday, rallying against the yen. The dollar index, which gauges the greenback against six counterparts including the euro and yen, rose 0.10% to 98.420, building on Thursday’s 0.50% climb.

Based on the current price in USDJPY, the overall trend looks bullish. Price has broken recent high and resistance level of 122.30 to push to the bullish direction. There is also a price break of the 50 EMA which confirms the change in direction of rice. The RSI is above the centre-line for added confirmation.

PIVOT POINT: 122.30

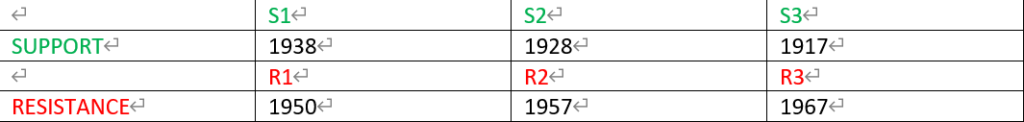

GOLD SPOT (XAUUSD)

Gold trades up today as investors are looking for a safe haven, due to the uncertainty of the outcome of the Russian-Ukrainian talks. In other matters, market participants are waiting for the upcoming Non-Farm Payroll (NFP). It is expected that the NFP will be around 492K down from 678K.

The bullish trend is likely to continue in the new fiscal year amid the spectre of rising retail prices, hardening interest rates, and geopolitical tensions. From the overview of price in XAUUSD, the overall trend looks bullish. Price is testing around the support level of 1,938 which has confluences with the retest of the 50 EMA and the 61.8 Fibonacci retracement level before a possible move to the bullish direction. The RSI and MACD are above the centre-line for added confirmation.

PIVOT POINT: 1938

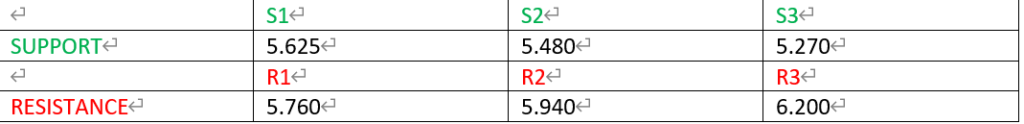

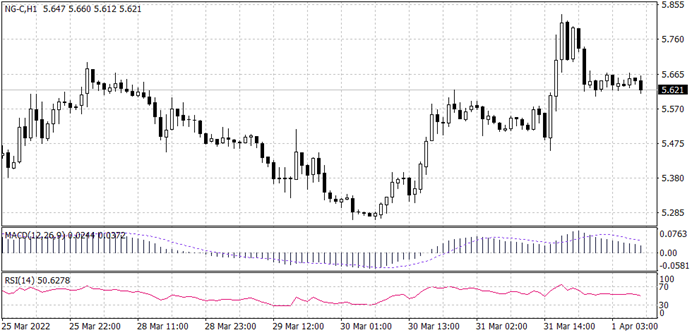

NATURAL GAS (NG)

The U.S. State Department spokesperson Ned Price said on Thursday that Russian President Vladimir Putin’s demand that foreign buyers pay for Russian gas in robles is a sign of Moscow’s economic and financial “desperation” caused by Western sanctions in response to the invasion of Ukraine. European nations, which rely heavily on Russian gas, have rejected the demand.

The current price of Natural gas looks bullish. Price is currently testing the support level of 5.625 which is in confluence with the 50.0 Fibonacci retracement level and a likely retest of the 50 EMA and a bounce to the bullish direction from the upward trend-line. The MACD and RSI are above the centre-line for added confirmation.

Pivot point: 5.625