April 27th Daily Analysis

April 27th Daily Analysis3

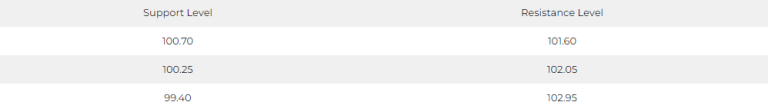

DOLLAR INDEX (USDX)

The US dollar index decreased by 0.41% to 101.172 against a basket of foreign currencies, following a 0.5% rise in trading last Tuesday.

The major US market indices closed sharply lower yesterday, driven by the decline of First Bank’s stock, which fell by approximately 40%, renewing fears of a US bank crisis.

Pivot Point: 101.15

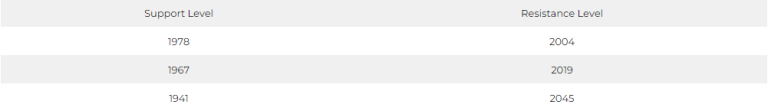

SPOT GOLD (XAUUSD)

On Thursday, gold prices saw an increase as the US dollar weakened in anticipation of a series of US economic data to be released ahead of the upcoming Fed’s monetary policy meeting.

Spot gold transactions went up by 0.4% and reached $1996.50 per ounce, while US gold futures saw a rise of 0.5% and reached $2005.20.

Pivot Point: 1993

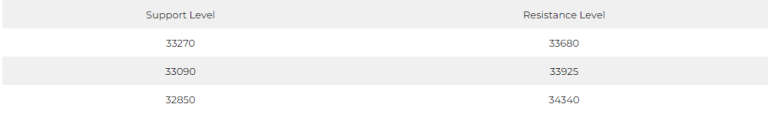

DOW JONES INDEX (DJ30FT – US30)

The Dow Jones index recorded a decline of 0.7%, or approximately 228 points, marking its second consecutive session of retreat and losing all gains achieved in the month of April.

Following Wednesday’s disappointing capital goods data and weak UPS results on Tuesday, the transportation sector – which is sensitive to economic fluctuations – also suffered a decline for the second consecutive day.

First Republic Bank shares hit a new record low, falling by 30%, after reports revealed that the US government was not willing to coordinate a bailout of the bank, despite it reporting more than $100 billion in deposits in the first quarter.

Pivot Point: 33515

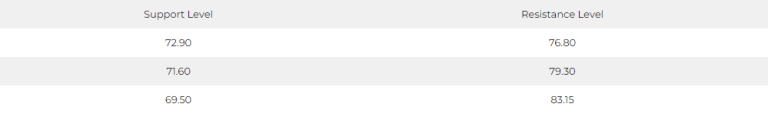

US CRUDE (USOUSD)

On Wednesday, oil prices plunged by approximately 4%, extending the steep declines from the prior session, as a report revealed that US crude inventories dropped more than projected. This comes as concerns about a potential recession in the world’s largest economy continue to mount.

Brent crude settled at $77.69 a barrel, losing $3.08, or 3.8%. West Texas Intermediate crude recorded $74.30 a barrel, down $2.77, or 3.6%.

Pivot Point: 75.40