January 02nd Daily Analysis

January 02nd Daily Analysis

U.S. DOLLAR INDEX (USDX)

The dollar index futures traded slowly this morning on account of the new year holidays across most of the world. Yet, the dollar weakened in recent months after data showed that U.S. inflation has likely peaked, which is expected to invite a slower pace of rate hikes by the Fed.

Technically, the dollar index remains downtrend, targeting 103.10 on the hourly chart. RSI and MACD signal a slow decline while Bollinger bands show a possibility of a rebound.

Pivot Point: 103.25

CHINESE YUAN (USDCNH)

The Chinese yuan fell 0.1% in offshore trade, with economic readings released over the weekend showing that manufacturing activity in the country shrank even further in December, as the country grapples with an unprecedented spike in COVID-19 infections.

Still, markets are positioning for an eventual economic recovery in the country, as it re-emerges from nearly three years of strict lockdown measures which had severely hampered growth.

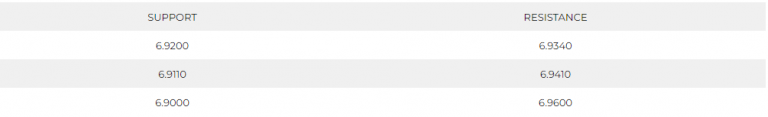

Pivot Point: 6.9250

BITCOIN (BTCUSD)

Bitcoin traded higher this morning as traders move liquidity from the stock market. Markets risk appetite increase helped the cryptocurrency market to gain a little momentum over short time frames.

On the hourly time frame, technical indicators show bitcoin on the overbuying side while the moving average indicates a possibility of further gains. Meanwhile, the daily chart shows a horizontal movement and low trading volume. Technical indicators also show neutral signals.

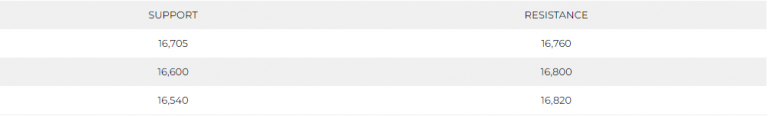

Pivot Point: 16,740