December 15th Daily Analysis

December 15th Daily Analysis

U.S. DOLLAR INDEX (USDX)

The dollar climbed considerably on Thursday after the Federal Reserve raised interest rates by an expected 50 basis points overnight, and its policymakers anticipated making further hikes and keeping rates high for longer than earlier hoped.

Setting out the Federal Open Market Committee’s determination to tame inflation despite a risk of recession, Fed Chair Jerome Powell said the FOMC expects rates to peak above 5%. Fed funds futures show that markets are expecting U.S. rates to peak just under 5% by May 2023 which is lower than what the Fed has conducted.

Pivot Point: 103.70

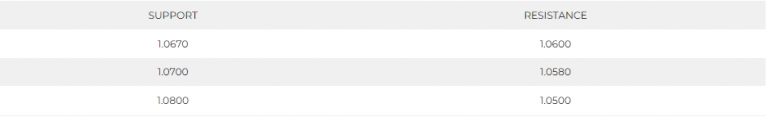

EURO (EURUSD)

Markets now turn their attention to rate decisions by the European Central Bank (ECB) due on Thursday, with expectations to deliver a 50 basis point rate hike.

The Euro remains in the uptrend despite the correction happened overnight. The hourly chart shows a dip towards 1.0605 but the daily chart says otherwise. The daily chart shows a continuation of the uptrend.

Pivot Point: 1.0630

SPOT GOLD (XAUUSD)

Gold prices fell below $1,790 per ounce after the Federal Reserve struck a more hawkish chord than markets expected, with the outlook for the yellow metal remaining uncertain on the prospect of higher U.S. interest rates.

Pivot Point: 1,775

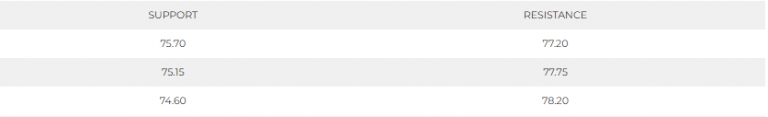

WEST TEXAS CRUDE (USOUSD)

Oil prices dipped in Asian trade on Thursday as the dollar firmed, while the possibility of further interest rate hikes from global central banks also heightened demand concerns.

Brent crude futures fell 0.8% to $82.06 per barrel, while U.S. crude futures slid 1.0% to $76.54. Both contracts fell as the dollar gained.

While the outlook for demand improved, an unexpected jump in U.S. crude oil inventories signaled that near-term consumption remained subdued. U.S. inventories rose by a staggering 10 million barrels in the week to December 9, even as the government ceased its drawdowns from the strategic petroleum reserve. Gasoline inventories grew twice as fast as expected, signaling that consumer demand for fuel remained under pressure.

Pivot Point: 76.00