November 04th Daily Analysis

November 04th Daily Analysis

U.S. DOLLAR INDEX (USDX)

On Friday, the dollar looked set to post its best week in over a month on expectations that U.S. rates could peak higher, while sterling was on the ropes as investors revised their rate projections after a shift in tone from the Bank of England.

The U.S. dollar index fell 0.23% to 112.71, away from a near two-week peak of 113.15 hits overnight. Fed rate futures now point to a terminal rate of about 5.15% by mid-2023, after the Federal Reserve raised interest rates by three-quarters of a percentage point this week.

Markets are focusing on U.S. jobs data due later today, with economists polled by Reuters expecting nonfarm payrolls to have increased by 200,000 jobs in October. The index remains positive on the daily chart while despite the strong corrective downtrend. While RSI and Moving Averages support the positive trend, MACD also shows high divergence and the possibility to further correction.

The index was moving in a downtrend from the resistance at 112.80 heading towards 112.10. the hourly chart shows a further decline as technical indicators signal weak buying pressure. Meanwhile, the daily chart remains positive with no strong resistance before 114.

Pivot Point: 112.40

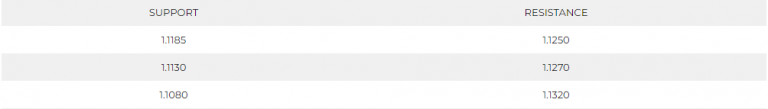

STERLING POUND (GBPUSD)

Sterling was up 0.50% at $1.1215, clawing back some of its losses from a 2% slide overnight. It was heading for a weekly loss of more than 3%, the largest since September’s market turmoil triggered by an economic plan that alarmed investors.

While the BoE raised interest rates by the most since 1989 on Thursday, it warned investors that the risk of Britain’s longest recession in at least a century means borrowing costs are likely to rise less than they expect.

Despite the positive movement this morning, the Sterling pair remains under heavy selling pressure. The hourly chart indicates a possible continuation of the corrective trend towards 1.1270. However, the daily chart shows a more bearish tendency.

Pivot Point: 1.1220

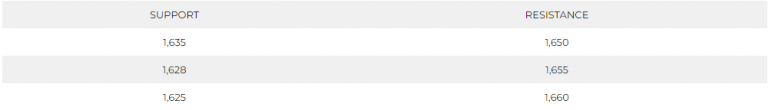

SPOT GOLD (XAUUSD)

Rising interest rates and strength in the U.S. dollar are expected to keep metal markets subdued in the coming months. Gold, which is more sensitive than most metals to interest rates, was set to lose about 1% this week after the Fed hiked rates and signalled more monetary tightening.

Spot gold rose 0.1% on Friday to $1,631.88 an ounce, while gold futures rose 0.2% to $1,633.75 an ounce. Focus now turns to U.S. nonfarm payroll data due later in the day, which is expected to show resilience in the jobs market. This is likely to give the Fed enough economic headroom to keep raising interest rates, as the bank signalled this week.

Technically, spot gold remains negative on the daily chart and targets $1,620 per ounce with little to no support before that level. Technical indicators show a probability of a horizontal movement or neutral momentum. Meanwhile, the hourly chart shows a continuation slowly to the downtrend.

Pivot Point: 1,647

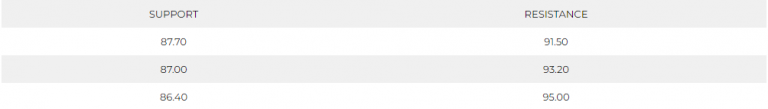

WEST TEXAS CRUDE (USOUSD)

Oil prices rose on Friday as markets awaited the passing of a price cap on Russian exports, although concerns over Chinese demand and a hawkish Federal Reserve put crude on course to end the week lower. Group of Seven (G7) countries agreed to set a fixed price when curbs on Russian oil exports kick in later this month. The passing of the price caps is expected to tighten crude supplies, given that Russia warned it will stop supplying oil to any countries that agree to the curbs.

Brent oil futures rose 0.6% to $94.18 a barrel during the early sessions, while West Texas Intermediate crude futures rose 0.6% to $88.69 a barrel. But Brent was set to lose around 1% this week, while WTI futures were set to close the week flat.

Pivot Point: 89.60